What Do Rising Rates and Tenure Length Mean for Housing Market Potential in 2020?

Written by First American Chief Economist, Mark Fleming

In October 2019, the housing market exceeded its potential, as actual existing-home sales exceeded market potential by 4.6 percent, or an estimated 239,000 seasonally adjusted annualized sales. Housing market potential decreased relative to last month, but increased 0.6 percent compared with October of last year.

“The market potential for existing-home sales in 2020 will largely depend on the strength of the rate lock-in effect and whether house-buying power can increase sufficiently to offset it.”

Two forces drove the month-over-month decline in the potential for existing-home sales – a month-over-month decline of 0.8 percent in consumer house-buying power, the first decline since November 2018, and the continued impact of rising tenure length. The decline in house-buying power dampened market potential substantially. Examining how house-buying power influences market potential can provide insight into the outlook for the housing market.

First Monthly Rate Increase Since November 2018 Holds Back Housing Market Potential

In 2019, consumer house-buying power, how much home one can afford to buy given household income and the prevailing mortgage rates, surged and provided a significant boost to housing market potential. Since the start of 2019, income has grown by 1.9 percent and mortgage rates have fallen by 0.77 percentage points, both dynamics sending house-buying power higher. As a result, house-buying power jumped 12.0 percent between January and October 2019.

In October, mortgage rates increased by 0.08 percentage points, the first monthly increase since November 2018. While household income increased by 0.2 percent compared with one month ago, it was not enough to offset the negative impact of the increase in mortgage rates on house-buying power. The resulting decline in house-buying power dropped the market potential for existing-home sales by nearly 22,000 sales.

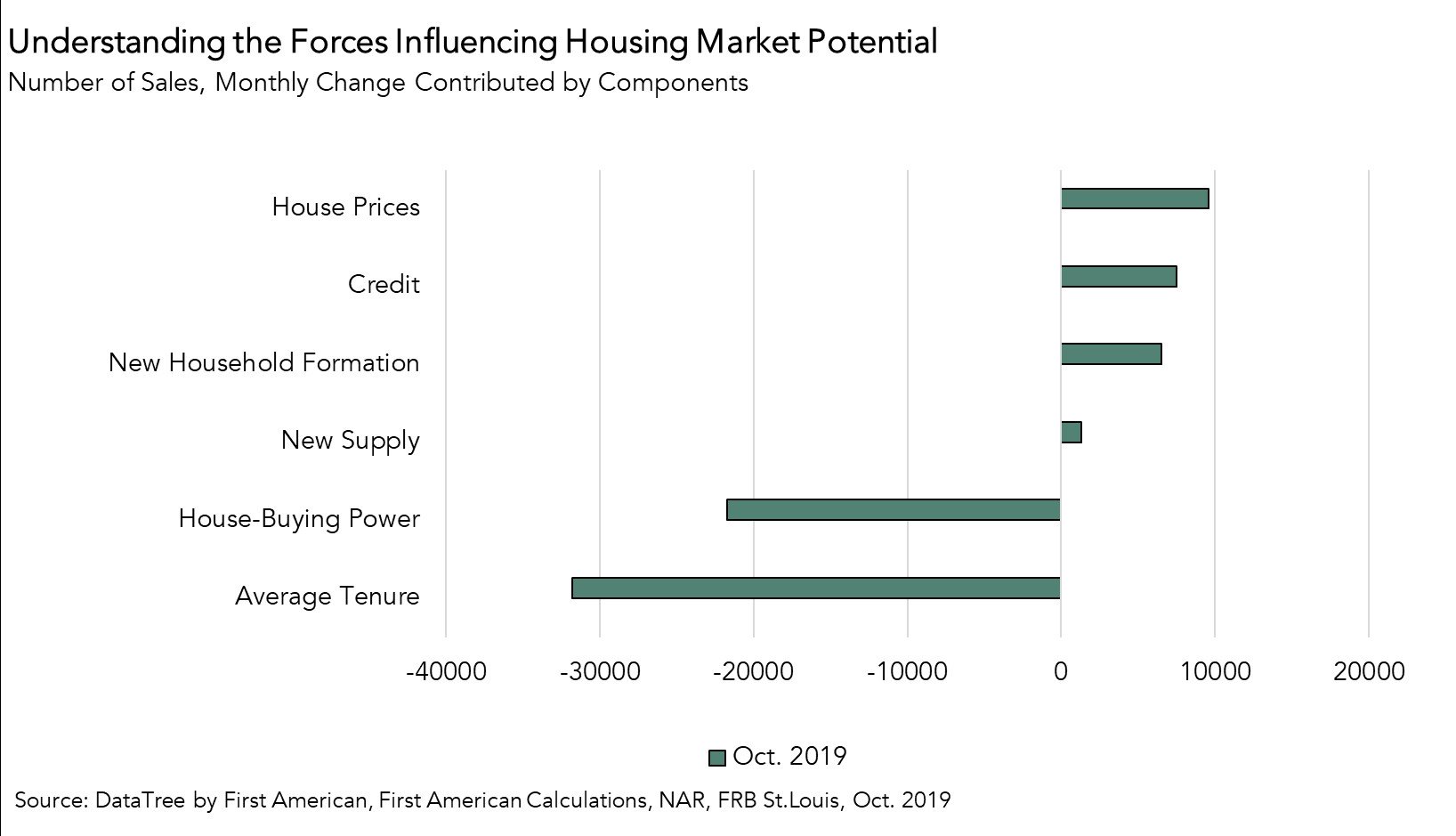

Tenure length, the average length of time someone lives in their home, increased in October by 6.0 percent compared with January 2019, and 0.7 percent compared with last month. Increasing tenure length reduced the market potential for existing-home sales by 31,800. Tenure length and house-buying power are two of the most influential forces on market potential, and they combined to drag down the market potential for existing-home sales by 0.6 percent compared with last month, despite positive contributions from new home construction (1,300 potential home sales), looser credit standards (7,500 potential home sales), rising house prices (9,600 potential home sales), and increasing household formation (6,500 potential home sales).

Impact on 2020 Outlook

One month of declining house-buying power is not a trend. Mortgage rates are currently hovering at 3.7 percent, and forecasters currently expect rates will remain somewhere between 3.7 percent to 3.9 percent in 2020 – still near historical lows. Meanwhile, household income is expected to continue to grow as wages rise. It’s possible that house-buying power in 2020 may dip lower than in the spring and summer of 2019, but will likely remain near historical highs.

As more buyers purchase homes with historically low rates and existing owners refinance, there will be more homeowners with a financial incentive to keep their current homes, and low mortgage rates, and not sell. This is the rate lock-in effect, and it means tenure length will likely continue to rise as well. The market potential for existing-home sales in 2020 will largely depend on the strength of the rate lock-in effect and whether house-buying power can increase sufficiently to offset it.

First American Exchange Company, LLC a Qualified Intermediary, is not a financial or real estate broker, agent or salesperson, and is precluded from giving financial, real estate, tax or legal advice. Consult with your financial, real estate, tax or legal advisor about your specific circumstances. First American Exchange Company, LLC makes no express or implied warranty respecting the information presented and assumes no responsibility for errors or omissions.