Code Section §121 or §1031: Which should I use to exclude or defer gain when selling a single-family home?

The answer to the question posed above depends on how you currently use the property in question. If it is declared on your tax return as a principal residence, then you would apply the §121 exclusion at closing. If you hold the property for rental, then you may utilize a §1031 exchange to defer your capital gains.

Section 121 is the Primary Residence Exclusion:

The primary residence exclusion under §121 allows taxpayers to exclude up to $250,000 of gain when selling their primary residence*, provided they have owned the property and lived in it as a primary residence for at least two (2) of the past five (5) years. This tax benefit can be used once every two years. The exclusion is $500,000 for a married couple that files a joint return. Note that each spouse must have lived in the subject property for the requisite two of the past five years, and neither spouse may have used the exclusion on another home in the previous 2 years.

*A vacation or second home is treated differently: Read more.

In a §1031 exchange, any real property can be exchanged, so long as at the time of sale it is held “for productive use in a trade or business” or for “investment,” and so long as it is exchanged for real property of “like-kind” that will also be held by the taxpayer for one of these same purposes.

There are two parts to the exchange transaction: “transfer” of relinquished property and “acquisition” of replacement property. The taxpayer must acquire title to the replacement property in the same manner as title was held in the relinquished property. There are some exceptions to this rule, such as if a taxpayer acquires title in an entity that is disregarded for tax purposes.

Many criteria must be met, including:

- Taxpayer must buy replacement property(ies) of greater or equal value to relinquished property(ies);

- Taxpayer must reinvest all proceeds from the sale of the relinquished property(ies) in replacement property(ies);

- Taxpayer must obtain new financing equal to or greater than the debt paid off when selling the relinquished property (or, replace the debt with additional cash invested in the replacement property(ies)).

There are two deadlines to adhere to in a §1031 exchange, each of which begins on the date of transfer of the first relinquished property:

- Replacement property(ies) must be identified within 45 days;

- The exchange must be completed by the earlier of: (a) 180 days from the date of the first relinquished property closing; or (b) The due date of the taxpayer’s federal income tax return, together with all extensions, whichever comes first.

If the above rules and criteria are met, a taxpayer may defer all their capital gains liability from the sale of their relinquished property. The taxpayer will not owe taxes for this gain until the replacement property is sold (unless another 1031 exchange is done at that time).

How can I Use both Section 121 and 1031 when selling Mixed-Use Property?

It’s possible to use a property both for primary residence and investment purposes, either simultaneously, or at different times, and to make use of both §121 and §1031 when selling the property – stay tuned for our upcoming in-depth article on mixed use exchanges.

What if the property that is being sold was used as a primary residence for at least 2 of the past 5 years, but is currently used as investment property? In some scenarios, both the exclusion under §121 and a §1031 exchange may be utilized at the time of sale of such a property.

As of 2009, the available §121 exemption is reduced to the extent a taxpayer used their property for investment purposes during their period of ownership. There is a formula to determine how much gain a taxpayer cannot exclude. The formula is below – qualified use = use as a primary residence, where non-qualified use = use as anything else:

Years of non-qualified use*

----------------------------——-- x GAIN = Amount of gain NOT eligible for §121 Exclusion

Years of total ownership

* Neither non-qualified use prior to January 1, 2009, nor non-qualified use occurring after the last period of qualified use, is included in the “Years of non-qualified use” portion of the calculation.

The below are examples in which both the exclusion of §121 and the deferral mechanisms of §1031 could both be used in order to exclude and defer payment of capital gains tax:

Example 1:

A married couple (filing jointly) purchases a home in 2010. This couple lives in the home for 3 years and then converts it to an investment property. Two years later, the couple sells the home for total gain of $650,000. What is the amount of their “non-qualified” gain?

There is no “non-qualified” gain in this example because the non-qualified use occurred after the qualified use. The couple in this example can take $500,000 of the total gain tax free. They can also enter into a 1031 exchange to defer the rest of the gain.

Example 2:

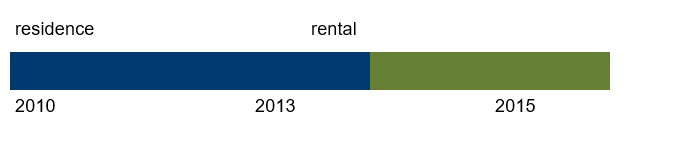

An individual purchased an investment property in January of 2010. This individual converts the property to her primary residence on January 1, 2012. After living in the home for 3 years, the individual moves out and rents the property out for 2 years. The individual then sells the property for a total gain of $250,000. What is the amount of the “non-qualified” gain?

2

---- x $250,000= $71,428.55

7

Even though this individual rented out her home for 4 years, the 2 years after the last period of qualified use do not count in the calculation. Only the initial 2-year rental period is included for calculating the non-qualified gain. The individual may thus take $178,571.45 gain free ($250,000 exclusion minus non-qualified gain). The rest of her gain can be deferred with a 1031 exchange.

Example 3

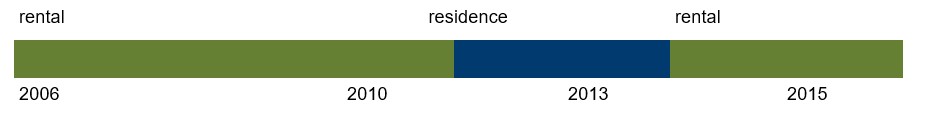

An individual purchased an investment property in January of 2006. This individual converts the property to his primary residence on January 1, 2010. After living in the home for 3 years, the individual moves out and rents the property out for 2 years. The individual then sells the property for a total gain of $300,000. What is the amount of the “non-qualified” gain?

1

---- x $300,000= $33,333.33

9

In this example, only one year of “non-qualified use” counts in the calculation. The years prior to January 1, 2009 do not count and the years of non-qualifying use AFTER the last period of qualifying use also do not count. Therefore, only the one year (2009) is included in the calculation. $33,333.33 of the total gain is non-qualifying and thus, only $216,666.67 can be excluded. The rest of the gain may be deferred with a 1031 exchange.